3 Ways AI Can Drive Financial Inclusion

Financial inclusion is vital for building economic resilience and improving lives around the world.

Yet today, 1.4 billion adults - nearly a quarter of the global population - still lack access to even basic financial services. AI offers a powerful opportunity to bridge this gap, unlocking new pathways to banking, investment, and financial education for underserved communities.

Our CEO Livia was recently featured in The AI Journal - here we summarise three important points from the piece.

1. AI’s Role in Expanding Access

AI has the potential to transform how people access banking and investment services.

Traditional financial institutions often exclude individuals without formal credit histories or stable incomes, but AI-driven tools can change this. For example, intelligent algorithms can analyse alternative data - such as spending habits, mobile usage, and payment behaviours - to generate fairer, more inclusive credit scores.

Companies like Experian and Tala already use these methods to offer loans and financial products to people previously overlooked by conventional systems.

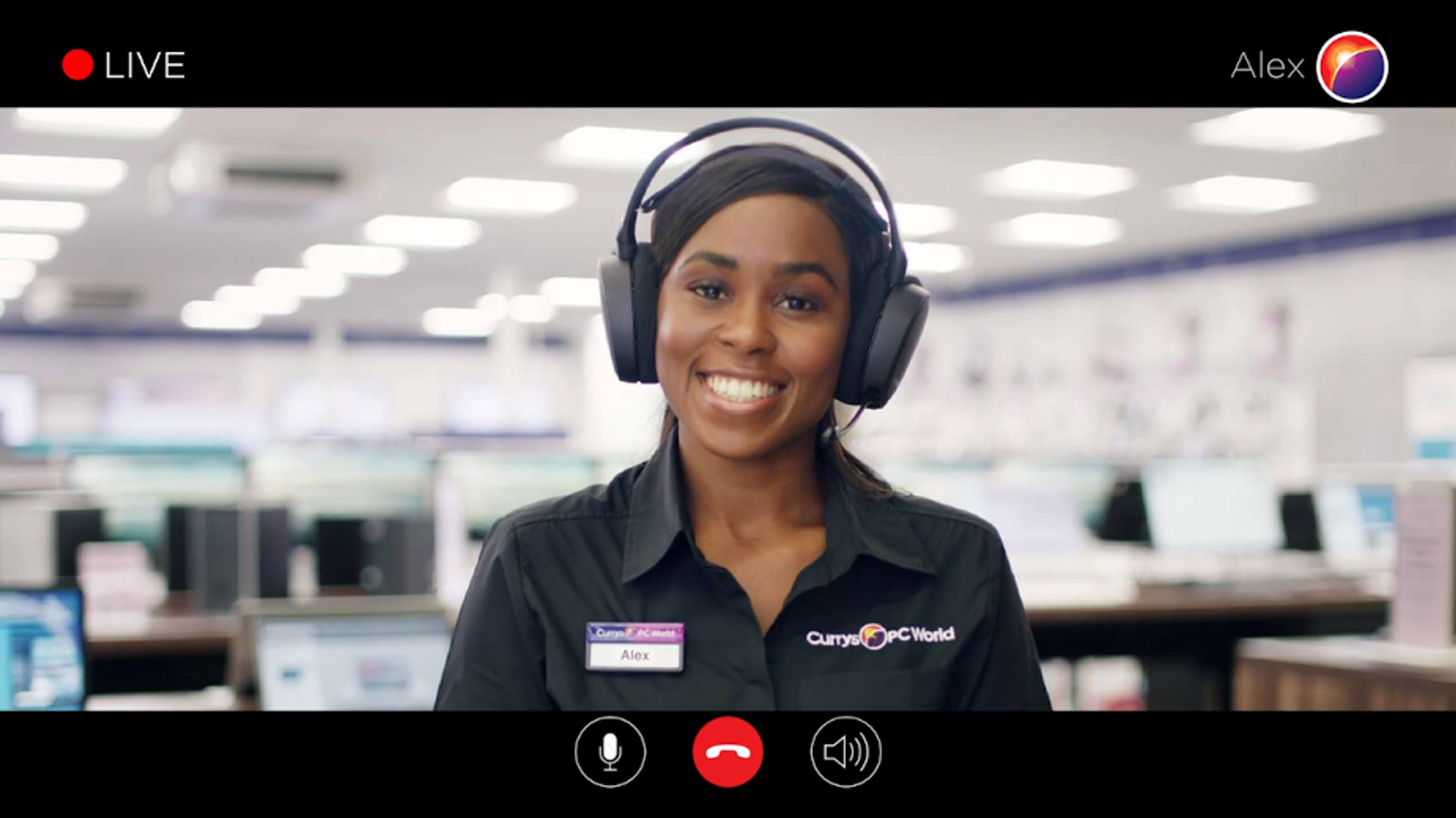

Beyond credit, AI-powered apps like Acorns automate micro-investments and savings, adapting to user behaviours to make investing accessible to first-time or lower-income savers. In parallel, conversational AI tools such as Cleo are helping improve financial literacy, delivering clear, jargon-free guidance in a tone that feels friendly and approachable.

By personalising advice and lowering barriers, AI can empower individuals to make smarter financial decisions and build wealth over time.

2. Ethical Considerations

While the benefits of AI for financial inclusion are compelling, they come with critical ethical responsibilities. Data privacy must be protected, users deserve transparency about how their data is collected, used, and stored. Companies like Branch lead by example, being upfront with customers about data usage in their lending decisions.

Bias in algorithms is another major concern.

If left unchecked, biases embedded in historical data can perpetuate exclusion rather than solve it. Addressing this requires diverse teams, ongoing model audits, and the adoption of open-source bias mitigation tools to ensure fairness.

Transparency is crucial to building trust, especially when many AI systems operate as “black boxes”.

Organisations need to communicate clearly about how their AI tools work and how decisions are made. By prioritising ethics and openness, businesses can use AI as a genuine force for good in financial inclusion.

See our related post: AI-Driven Customer Experience

3. Agentic AI as a Scalable Solution

Despite AI’s potential, scaling these solutions has been challenging.

Many AI tools are excellent in theory but require significant human oversight to execute effectively, making them difficult to roll out broadly. Agentic AI, a new wave of AI systems designed to act autonomously while maintaining transparency and accountability, offers a promising solution.

Agentic AI can learn context, coordinate across systems, and operate independently within ethical guidelines. This means faster decision-making, more personalised user experiences, and wider reach without constant manual intervention.

In financial services, it could help extend fair credit, provide real-time support, and deliver financial education at scale - all while maintaining user trust.

AI is not a silver bullet, but when thoughtfully implemented, it can become a transformative tool for closing the global financial inclusion gap. By focusing on ethical design and embracing innovations like agentic AI, businesses can lead the way towards a more inclusive financial future.

If you’re exploring how AI can support your organisation’s goals and unlock new opportunities, we can help you scope your technical needs with clarity and confidence.